It’s human nature to think big. Within the crop protection industry, most companies aspire to reach a big, wide universe with each of their products. This explains why the word “niche” is often used dismissively or, at best, is associated with small, entrepreneurial companies entering the market with a specialized product or service that has limited sales potential. However, Context has seen that “finding a niche” is not a small or trivial matter. It’s one of the most powerful ways to drive sales growth and profitability. This is every bit as true for large companies as for mid-size or small ones.

Instead of aiming to be “master of the universe” with broad-label products, companies are wise to uncover each product’s strengths and points of uniqueness, relative to competitors. By narrowing the target market focus until a strong and unique position is possible, the product finds its niche—the place where higher share, margins and higher return on investment is possible. In essence: identifying smaller ponds where the product can be a big fish.

Ideally, niche identification occurs before product rollout, but it is also a very valuable way to reposition an existing product. Take, for example, an older fungicide/bactericide product that has been marketed under a broad label. It performs well in controlling several diseases on a broad set of different crops, but sales are trending flat and margins are low because plenty of other products vie for this same market and deliver comparable results. However, by performing a relative competitive position analysis (RCPA) that examines and narrows the variables (i.e., uses, crops, pests, diseases, etc.), it becomes clear this product outshines everything else on the market for inhibiting black chaff in wheat.

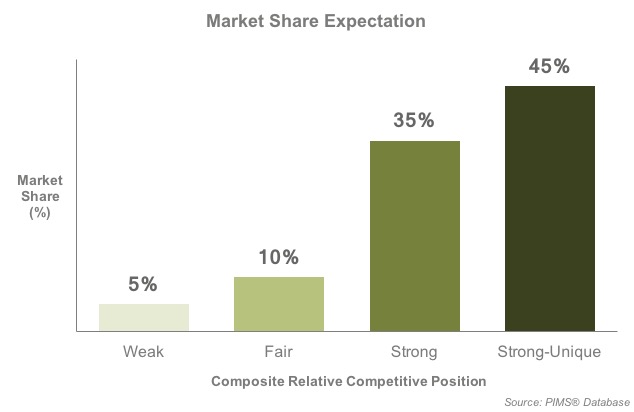

Based on years of performing product and portfolio assessments, Context Principal Mike Borel says, “It’s rare to see a broad-label product that has a strong-unique relative competitive position.” Conversely, narrow-label niche products meet a specific and well-defined need. They yield higher margins and achieve higher market share of a smaller target market because they offer a distinct value proposition. Borel points to the Profit Impact of Market Strategies® (PIMS) database from the Strategic Planning Institute, a comprehensive collection of anonymized information from more than 3,000 companies across all industries. “The PIMS data clearly shows that a strong relative competitive position has more influence over market share and business profitability over time than anything else,” says Borel.

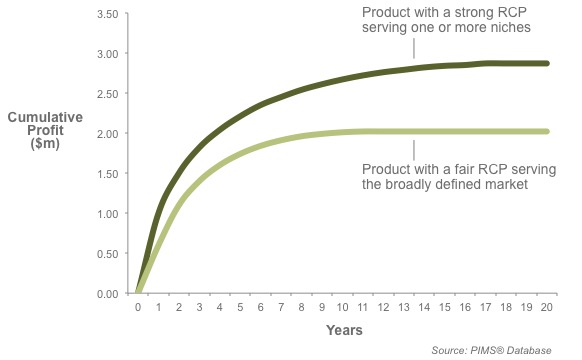

Granted, it is hard to shed the belief that more customers and bigger markets are better. By its very definition, a niche market has fewer customers than a broad market. However, the customers within a niche are willing to pay premium pricing for products that meet their needs markedly better than any competing products. On average, cumulative profit of products with a strong relative competitive position (RCP) pursuing a niche market are often greater than 25 percent higher than products with a fair RCP pursuing a broad market, as in the following chart.

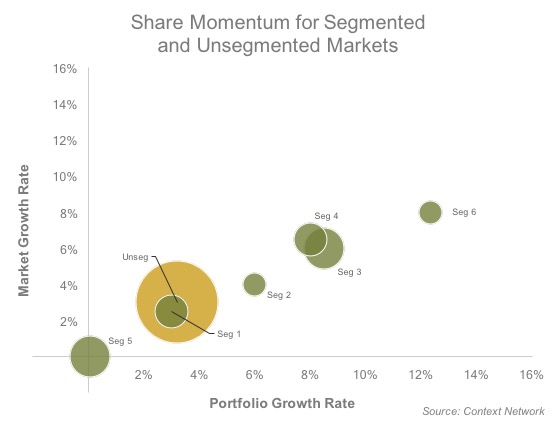

It’s also useful to think in terms of finding niche products with a strong RCP, not striving to be a niche company. A large crop protection company might, for instance, fill multiple niches with its product lineup. The growth rate for segmented markets compared to unsegmented markets is illustrated here.

Of course, focused or narrow targeting is not a new concept, but it is a surprisingly overlooked one. It’s especially relevant as the ag input sector undergoes another wave of consolidation, while also seeing exciting new technologies come to market.

Context Senior Associate Mike Kostrzewa notes: “Whenever there’s consolidation, you see overlapping portfolios that need to be rationalized, product by product.” Kostrzewa says insights from the RCPA can be leveraged a number of ways to maximize the value of existing portfolio assets, either through outlicensing, product extension, increased marketing to drive share, increased pricing, or disposition of products. “It’s worthwhile to consider the realizable niche value of older products before abandoning them or reducing support for them,” says Kostrzewa.

Kostrzewa says the RCPA process is equally valuable for companies introducing new technologies, such as biostimulants and biopesticides. He says: “There’s a big shift to softer chemistries coming to market, and it will be critical to understand how these new technologies compare to conventional ones. Performing an RCPA highlights any product’s strengths and weaknesses in specific situations and quantifies a product’s competitive position through a rating and/or ranking scheme.”

Size Matters

Focusing on niches where a strong, unique competitive position can be established and maintained yields big advantages, including:

• Little or no serious competition within a targeted market

• High margins because customers are willing to pay premium prices

• Stronger relationships with customers

• Focused spending on marketing

• Easier to sell

The Context Network has a strong record of helping ag input companies understand the relative competitive position of their products and the appropriate/optimum segmentation of markets to achieve higher profits and market share. For more information, contact Mike Borel at mike.borel@contextnet.com.