Market dynamics are driving players across the agriculture value chain to explore new pathways for innovation. With an increasingly challenging environment for novel product development, companies are considering other innovative ways to differentiate their offering and garner loyalty, including new business models. In this environment, a business model built around risk-sharing warrants a closer look. Christian Guffy, Partner with The Context Network, shares his point of view.

Many of the product innovations that shaped modern row crop production as we know it—such as traited seed and mechanization—are widely adopted and have largely become table stakes. Product-driven companies are also finding that it’s no longer realistic to solely rely on a new product pipeline to outpace the commoditization of legacy products or to work around go-to-market challenges. While there are pockets of tremendous innovation to the industry, many pipelines are generally not as robust as they once were. Rising regulatory costs and timelines have played a role in slowing the pace at which new products are approved for the market. The average cost to commercialize a new synthetic chemistry product now exceeds $350M, based on historical growth of development costs documented in one study.[i] Another study in 2022 showed that the average time to bring a new GM trait to commercialization increased 26% between 2012 and 2022.[ii] As a result, legacy crop input providers find themselves vying in an increasingly crowded marketplace, making it challenging to maximize the value of their products.

With this confluence of factors challenging and shifting product innovation in long-standing product categories such as chemistry and traits, the concept of engaging differently with customers has elevated in importance. While business model innovation can come in many forms, one of the most compelling approaches today is one in which companies participate in the the upside (returns) and downside (risks) with their customers.

In this article—the first in a series on risk mitigation—I will discuss the historic compartmentalization of risk and the potential benefits of relationships which seek to engage in risk sharing. In January, I’ll share strategies and considerations for risk sharing specific to the upstream market, including product-driven/input companies, retailers, and cooperatives. In subsequent articles, I’ll collaborate with Context colleagues to explore the possibilities and benefits of risk sharing throughout other segments of the value chain, including processing, distribution, and food production.

From segmented risk to integrated risk

Risk management isn’t new to agriculture and food production. Elements of risk have always permeated the sector—from the continuous risk of inclement weather that growers face, to the risk of ingredient scarcity that food companies aim to address when they negotiate supply contracts.

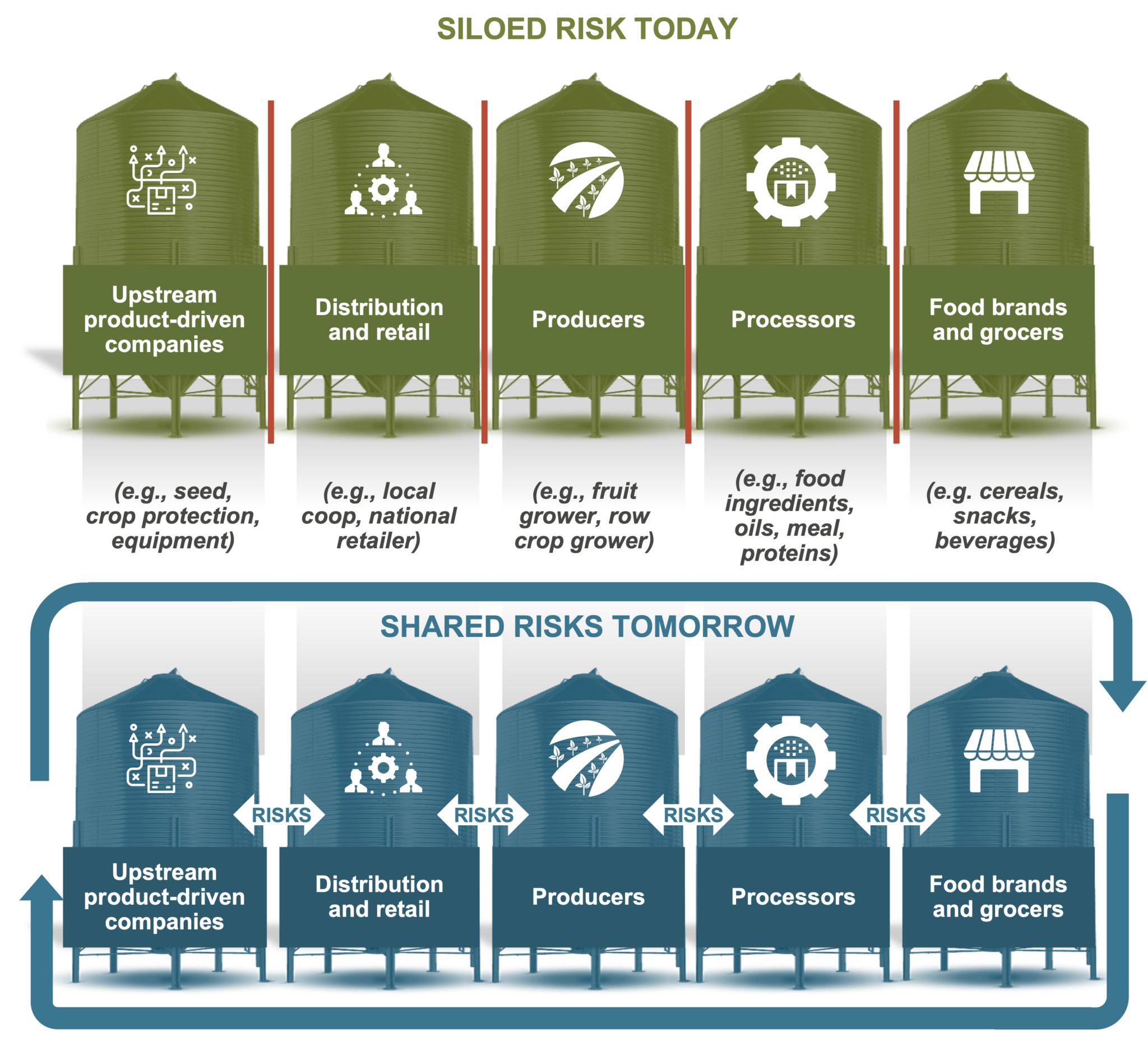

Yet, while every player in each component of the value chain bears business risks (and some of those risks, such as capital risk, are universal), these risks have historically been highly compartmentalized. Equipment, crop protection, crop nutrition, and seed companies, for example, shoulder the risk of inventing new products and pricing them right for profitability and ROI with growers. Retailers and distributors bear the risk of building infrastructure and hiring the labor needed to be the boots-on-the-ground with growers. They also have to manage the right level of inventory to deliver product just in time. Growers assume the risk of choosing which products to use for the season, coupled with heaps of execution risk centered on in-season production factors. Processors and traders carry their own set of significant fixed asset risks, along with market and trading risks which largely hinge on macro-demand factors. The list of relatively siloed risks goes on throughout the value chain.

Historically, risk is siloed across the value chain:

A traditional value capture model reinforces fragmented risk, as it is predicated on companies setting a price that is passed along to the next value chain participant, and the price is based on expected return on investment (ROI), not actual ROI. Once a product is purchased, all risk and potential reward shifts to the buyer. Said differently, if a product performs well, the buyer enjoys great outcomes. If a product doesn’t perform as expected, the buyer bears the consequences of the poor outcome. Likewise, if a product performs extremely well, the seller doesn’t financially benefit from the upside of that performance, as the price (and risk) was already passed along.

In the traditional value capture model we’re all familiar with, the market naturally adjusts product pricing over the long term. Growers won’t keep using consistently poor performing inputs, food brands won’t keep purchasing subpar ingredients, etc. However, in the short term, players in different segments of the value chain bear the swings in “fortune” of a historically volatile system, as weather events decimate crops or global conflict hobbles the commodity supply chain, for instance.

What if this paradigm changed? What would it mean to adopt an innovative business model in which companies choose to engage in certain risks with their customers and/or other downstream value chain participants? What would it mean if you choose not to engage?

In a risk sharing model, players purposefully assume some of the risk they would traditionally pass on to another segment of the value chain—with the goal of also sharing profit or savings in the event of success. It’s worth noting that the practice of risk sharing already exists within certain segments of the value chain. The grower cooperative system, for example, is functionally designed to ensure that individual growers will be somewhat insulated in scenarios where they might otherwise be at risk due to their negotiation power. Warranties are a form of risk mitigation as well. Risk sharing models are also familiar in other industries, like performance-based programs in healthcare, in which doctors receive a portion of their payment based on quality of care.

In addition to the market forces described earlier, another key factor enabling business innovation through risk sharing is the increasing abundance of agricultural data. The ongoing proliferation of data collection and analysis tools make it more feasible to accurately capture and more accurately attribute the value of product performance, though significant progress is still needed to bring this fully to life. Value attribution will ultimately be the key to linking specific product or practices to intended outcomes. This means pricing can be assessed based on actual ROI, a win for both parties over the long term.

Business model innovation based around risk sharing will have an increasingly profound impact in the food and agriculture industry. Several companies are actively engaged in piloting risk participation programs. Consider how a risk sharing strategy (or not pursuing one) aligns with your business goals and how it might impact your customer and supplier relationships.

Ask yourself:

-

- Which risks and which value chain partners will be most meaningful to engage with? For example, a product company may choose to engage in and growers in their execution risk.

- What band(s) of risk are you willing to engage in, and how will it affect your own credit position and cash flows? For example, reconciling product performance at harvest could push cash flows three to six (or more) months later for many input companies.

- What kind of value exchange mechanisms need to be crafted or leveraged? There are many mechanisms, such as performance guarantees, value-based contracts, cash-back programs, contract production, bonus triggers, etc.

At The Context Network, we’re helping organizations explore new business models and other innovation pathways to help them succeed. Through our deep business knowledge and broad network of experts, we can help you evaluate opportunities and craft strategies. To discuss what risk sharing could look like for your business, reach out to me at christian.guffy@contextnet.com.

Christian Guffy, Partner, brings experience in consulting, strategy development, and financial analysis in a variety of industries including agribusiness, investment finance, and retail. He has helped clients develop long term strategic plans as well as annual go to market strategies rooted in fundamental market analysis and research. He has also advised companies on corporate financial planning including capital expenditures, business unit divestitures, and strategic acquisitions. As a result of these client engagements and his prior experiences, Christian is well suited to engage clients in pursuit of their overarching business objectives.