Refining business operations can help manufacturers of crop protection products dig up what might be called buried treasure, increasing profits without generating a response from competitors.

Taking steps to uncover that treasure—by improving inventory turns—can improve not only the company’s balance sheet, but also its profit and loss statement.

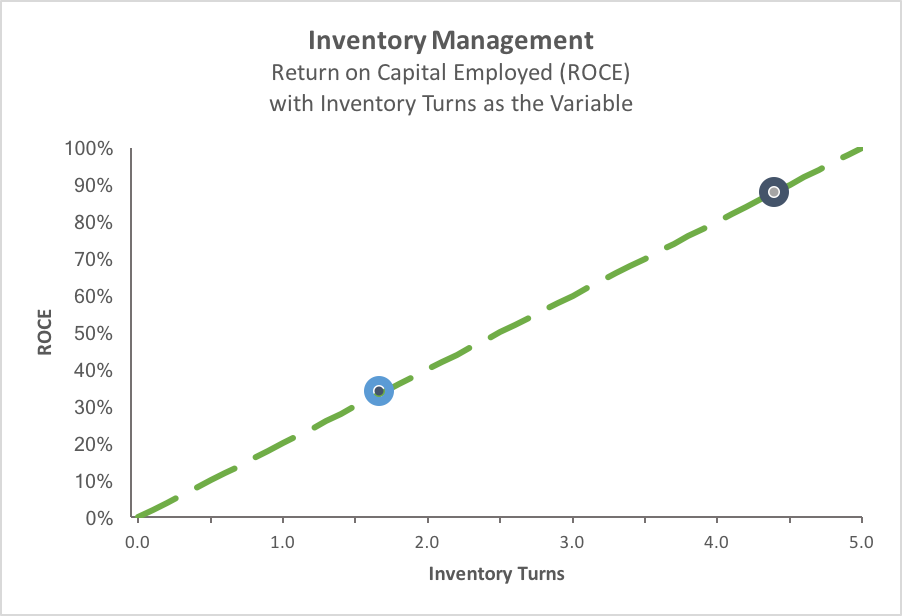

A Context Network® benchmarking study of crop protection manufacturers in North America shows that inventory turns averaged 1.7 per year in 2016. Performances ranged from 0.8 to 4.4 turns per year—a vast spread from low to high. The best-in-class performance was more than 2.5 times the average and a whopping 5.5 times the low.The numbers show that manufacturers have an outstanding opportunity to improve inventory turns and thus their return on capital employed and, ultimately, their bottom lines, says Context Principal Mike Borel. He cites one manufacturer that had inventory turns of 1.0 but believed much more was possible. “The company instituted a good process and made what turned out to be a very smart ‘out-of-the-box’ hire of a supply chain manager from an unrelated industry in which high inventory turns were the norm,” he says. In just three years, the manufacturer achieved turns near the best in the industry.

Such improvements fly under the radar. “The beauty of this is that it doesn’t attract a competitive response like you would see with a change in prices, terms, or programs,” Borel says. “You get the benefit without having to fight the battle.”

In planning and implementing improvements in inventory control, it’s critical to maintain a customer focus. “The goal is to get the right inventory in the right place at the right time,” says Context Senior Associate Mike Danner. “Inventory turns require the product to be in the hands of those who need it within 24 hours—wherever they are.”

Different products call for different inventory-control standards. “Some products can be made available ‘just in time’; others must be available ‘just in case’ they are needed,” Borel says. “It’s critical for the company to segment its portfolio of products.”

Some products have high profit margins, are critical to customers, and/or are key to the company’s competitive strategy. “Such products require the company to maintain supply ‘just in case’ it is needed,” Borel says.

Other products have generic competitors and lower profit margins. “You want to manufacture those products ‘just in time,’” Borel says. “The perfect situation is that you make just enough product and, at season’s end, you have none left. In many cases, it’s actually OK to run out of these products!”

Improving inventory turns can require a sometimes-difficult change in thinking about business metrics. It might mean looking beyond such measures as revenues and market share—through which functional groups have traditionally been rewarded—and helping manufacturers see the bigger picture. “Business executives who can do that can dramatically improve their company’s financial results,” he says.

For example, Borel recommended that one manufacturer cut about 25 percent of its SKUs because they were more of a distraction than a value to the company. “The sales organization had a target on my front and my back,” Borel says. But 16 months after cutting the extraneous SKUs, the company’s sales were up and its profitability had improved dramatically.

Danner adds: “As you improve your turns, your profitability goes up—sometimes without even increasing your sales. That frees up cash in the business to apply where you need it.”

One of the trickiest parts of managing inventory turns is forecasting demand for crop protection products up to 18 months in advance. Forecasters look at factors such as weather patterns, crop prices (and thus how many acres farmers will plant in various crops), and anticipated pest pressures. “There are a lot of moving parts,” Borel says. “If you’re inaccurate in forecasting, you’re going to have a heck of a time managing inventory.”

One factor in improving working capital, Borel says, is simply recognizing what is possible within the industry. For example, 4.4 turns—the best-in-metric figure in 2016—would have been viewed as impossible a decade earlier, when the average was 1.0. “Now, across the industry, working capital management has improved significantly, but we still have vast opportunities for further improvement,” he says.

He notes that the process and benefits that apply to crop protection products apply to other products as well, regardless of business category or sector.

The Context Network has many years of experience in helping companies dramatically improve working capital turns while assuring appropriate service levels for customers. For more information, contact Mike Borel at mike.borel@contextnet.com.