While other protein production sectors may be making headlines during COVID-19, those along the egg supply chain are not immune to disruption. Members throughout egg’s supply chain are working through challenges presented to their triple bottom lines during this unprecedented time.

Eggs, you see, are not just produced for supermarket shelves. No. They serve a purpose for those in the foodservice and hospitality industry, often in their liquid form. A role left in the void as demand from those food sectors all but dried up, while consumers shifted their attention to in-home dining.

The unintended consequences of a shortage of shell eggs and a surplus of liquid eggs have led many in the egg sector wondering if there is an opportunity for changes in risk mitigation strategies moving into the future. This situation also shines a light on several lessons to be learned by the agriculture industry at-large.

At The Context Network, we wanted to dive a little deeper into this industry, exploring the known and the unknown in various sectors along this chain and areas that need to be explored further. This article is part of a 4-part series that takes a big-picture look into the impacts of COVID-19 on the industry and identifies a growing need for something more.

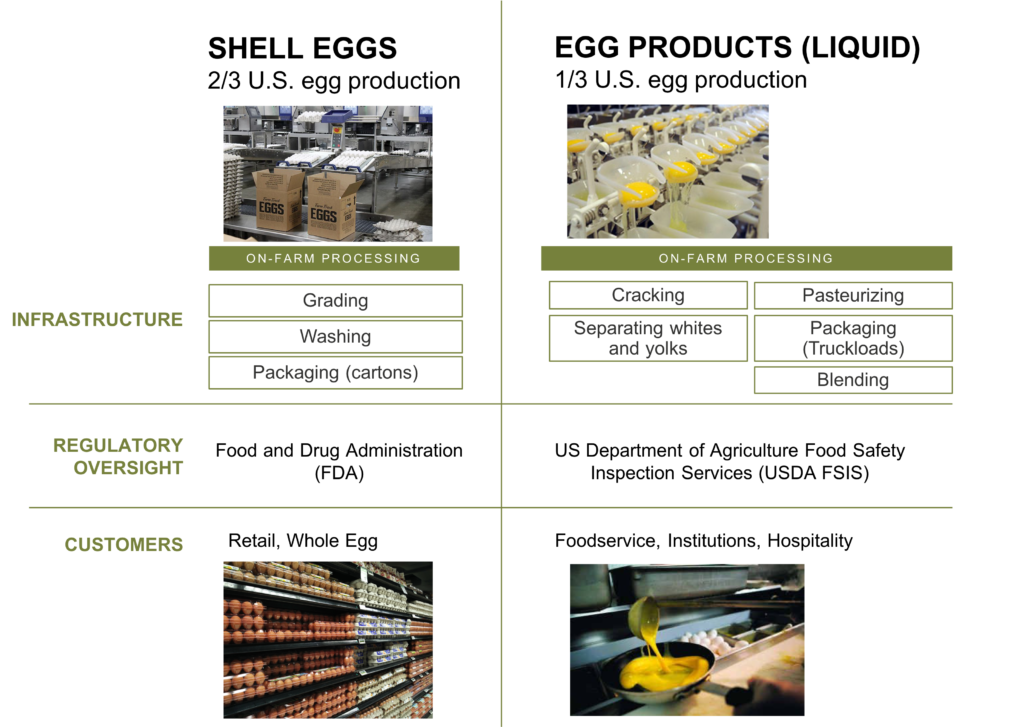

For those not intimately familiar with the egg industry: shell eggs and eggs produced for egg products serve distinct purposes. Due to modern production efficiencies and streamlined on-site market preparations, those systems do not overlap. While a surplus of shell eggs could end up in liquid egg or dried egg form, the inverse is not easily attained. Eggs used in liquid products are not required to follow the same FDA standards and thus, when a colossal shift happens in demand, the industry is not as flexible as many would hope.

It’s important to examine each shift in the egg sector through the lens of various players to have a more robust dialogue moving forward. When you examine the biggest impacts in the sector over the last several months, several key themes rise to the top. One area that remained flat and therefore was not discussed here is the dry egg market. Unfortunately, the others have not been this lucky.

Increased Demand for Shell Eggs

As consumers shifted from eating in foodservice and hospitality settings to eating at home, grocery stores saw an increased demand for shell eggs. This sudden increase in demand was followed by a short-term shortage on the back end. As a result of these supply and demand shifts, egg prices rose sharply causing push back from many states with price manipulation accusations.

Decreased Demand for Liquid Eggs

While shell eggs saw sky-rocketing growth, liquid eggs plummeted in demand and price. In fact, between March 25 and April 22 prices fell from 55 cents to 8 cents, a price that has rebounded somewhat over the last month.

Liquid eggs depend primarily on the foodservice, hospitality and baking industries for demand. The unfamiliarity of cooking with liquid eggs combined with the standard packaging sizes made liquid eggs’ transition to the retail market difficult. While some operations were able to meet standards for shell eggs or donate products to local food pantries, others were left dumping valuable nutrition and euthanizing animals prematurely.

Euthanasia, Waste

As demand dwindled, egg producers serving the liquid egg market were met with a flurry of economic, social and environmental implications. Price was the first shoe to fall, adding even more stress to an already financially challenged industry. But, finances weren’t the only trade-off here. As excess liquid egg was on the market, producers were left with the responsibility of its removal, with a significant volume of product ending up in landfills. With no timetable on the demand’s turnaround, many farmers made the difficult decision to begin euthanizing flocks, a decision that has long-term implications for their operations and the supply chain as a whole.

Throughout this series Context will continue to dive deeper into perspectives found on these issues throughout the supply chain. As we build the story, we continue to identify additional needs from the industry[1] as a whole. If you’re interested in working with Context to work through those issues, please contact me at matt.sv@contextnet.com

[1]United Egg Producers, Egg Industry Center and Oskaloosa Foods contributed to the development of this series.

Photo credit:

(Top Left) AndreaGantz, WATT AG