CONVERSATIONS IN CONTEXT

As agriculture and food industries strive to address climate change by reducing greenhouse gas emissions, organizations across food, fuel, and fiber supply chains are increasingly focused on carbon reductions as a key metric of success. Net-zero commitments supported by carbon-smart agriculture initiatives are gaining momentum in hopes of unlocking new value for farmers and corporations alike.

This collective energy galvanized around sustainability also creates a huge opportunity for agricultural players to now look beyond carbon by establishing goals that encompass a broader range of factors, including water, soil health, biodiversity, animal health and welfare, forest management, food security, human rights, and more.

Recently The Context Network Partners Matt Sutton-Vermeulen, Amanda Bushell, and Jason Nickerson met to discuss what it looks like when organizations widen the lens on sustainability by taking a systems approach. This article captures highlights of their conversation.

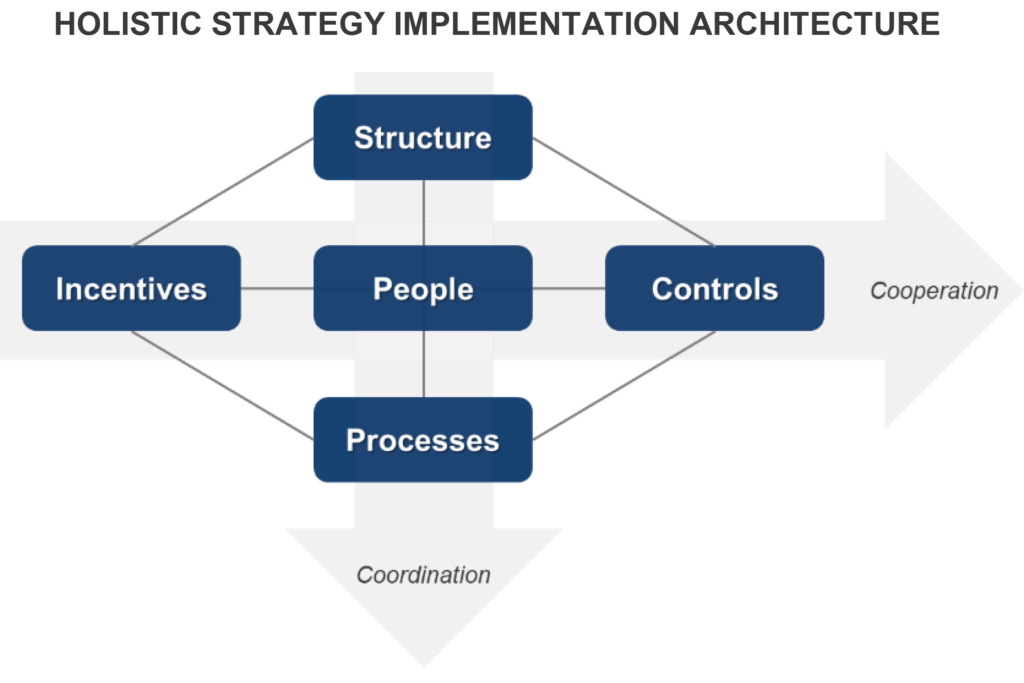

Sutton-Vermeulen: One of the reasons for the current focus on carbon is that it’s a quantifiable way to measure progress toward reducing emissions—and that’s vital for tackling the climate challenge. But as stewards of responsible supply chains, we can’t be so focused on carbon that we lose sight of the larger sustainability picture. That’s why a holistic systems approach can be powerful for organizations. It allows them to make decisions about carbon not just in the context of broader environmental, social, and economic impacts but also in accordance with how those decisions touch the lives and livelihoods of the people in those systems.

Bushell: Well, going back to the question of why everyone is focused on carbon, I’d argue that a big reason is because it’s a global issue with global implications. Other impacts like water, soil health, biodiversity, or labor can be managed on a smaller scale—at the watershed or even farm level. But you’re absolutely right that net zero doesn’t have to be a zero-sum game. Focusing on practices that are good for carbon can also be good for interrelated factors. For example, a recent report1 about crop insurance claims is eye-opening. In 2019, wet weather in the Midwest prevented planting on millions of acres and resulted in significant insurance claims. But researchers found that conservation practices like cover crops and no-till/reduced-till were linked to a 24% reduction in prevented-planting losses. This speaks to the fact that multiple factors—from carbon to water to soil health—are interrelated and have quantifiable impact on business, people, and the entire food system.

Sutton-Vermeulen: That’s a great example because it shows a systems approach doesn’t necessarily mean adding more goals or overwhelming organizations that already feel the pressure of sustainability targets and commitments. It’s about progress over perfection and understanding how progress in one area impacts other areas.

Nickerson: And how do you show progress? You’ve got to have quality data. It’s foundational for establishing credible baselines and measuring progress. Organizations need to have confidence in their data and operational systems that help them identify where they can have the biggest impact and how to do it most efficiently. Data also empowers people within an organization. If you’re asking someone to play a role in reducing your impacts, they need to understand—and, be part of—how the baseline was calculated and how progress is being measured, reported, and verified.

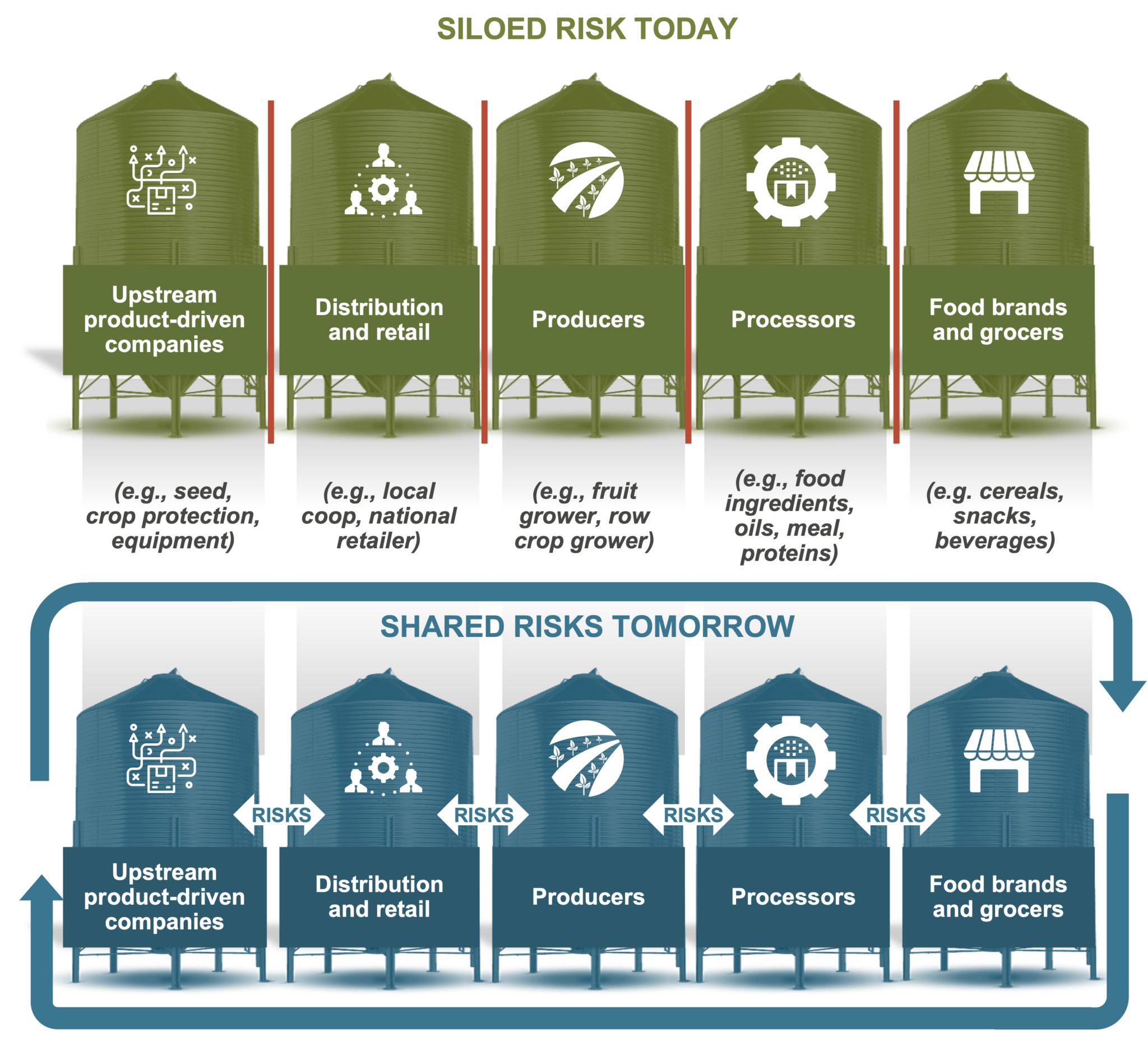

Bushell: I think the other piece of this is that some data and some interventions can and should be a competitive advantage for companies. But other interventions aimed at sustainability will require a collaborative, pre-competitive effort across supply chains, government, and NGOs. When we get to these nexus points, we’ll know because it will be impossible to answer certain questions on a company basis. They’ll need to be answered and addressed as an industry.

Sutton-Vermeulen: Right—and that’s where companies will need to bridge primary data from their own system with secondary data to fully understand how to engage with the larger community in the most impactful way possible. This is challenging many organizations as they shift from a project focus to a systems approach because significant gaps in the data require them to view progress over perfection.

Bushell: That’s a key point, Matt. It’s not a theoretical exercise. It’s about real people on the ground using regenerative practices and seeing outcomes that enable them to support their families.

Sutton-Vermeulen: And we’re just scratching the surface. In North America, around two percent of farmers have experience in carbon programs. That’s how nascent this still is and how narrowly focused it’s been on one area of sustainability.

Nickerson: When we open up transparent discussions about the bottom line of multiple impacts—from economic to environmental to social—more people are involved, and there can be more value shared across the value chain. And while impacts around topics like water efficiency, biodiversity, and human rights may be hard to measure and attribute precisely, that shouldn’t stop food and ag companies—who are working from a sense of responsibility—from trying to improve them.

Bushell: Yes, transparency is important, and the market needs to be consistent too. For instance, the official federal estimate for the social cost of carbon is $51 a ton, and there’s talk of raising that to $190 a ton. When signals shift too drastically, it takes some time for the market to mature and respond to it.

Sutton-Vermeulen: I agree that part of the issue right now is that the market signals are weak. We don’t yet have a mature market where price discovery takes place and where downstream players can signal, for example, that they’re interested in carbon but also interested in biodiversity and water—and upstream players can respond. But that’s changing fast as government and investor organizations drive for higher accountability around multiple aspects of sustainability. The industry’s focus on carbon targets and commitments is absolutely part of this evolution toward a mature market. As we get there, we need a systems approach that keep our eyes on other impacts to people, economics, and other critical indicators. That’s what it takes to build confidence and pride in supply chains that are responsible and truly sustainable.

How do you weigh the benefits, costs, and responsibilities of pursuing ambitious sustainability targets on topics beyond carbon, such as water, biodiversity, and human rights?

The Context Network Partners Matt Sutton-Vermeulen, Amanda Bushell, and Jason Nickerson bring decades of experience in driving continuous improvement in responsible food, fuel, and fiber supply chains, adding financial, environmental, and social value. They help clients advance agriculture through a well-honed systems approach rooted in experience, tapping the breadth of Context’s dynamic network to consistently deliver actionable solutions tailored to each organization, its culture, its priorities and intended outcomes. To learn more, reach out to Matt, Amanda, or Jason.

1 Conservation and Crop Insurance Research Pilot – AGree: Transforming Food and Ag Policy